Personal injury cases can often drag out for years in a confusing manner. This is especially true when there are disagreements about the proper venue and subject matter jurisdiction. A recent appeal discussed below tackles the challenges of dismissal of actions due to a lack of jurisdiction and the timing requirement of prescription.

Personal injury cases can often drag out for years in a confusing manner. This is especially true when there are disagreements about the proper venue and subject matter jurisdiction. A recent appeal discussed below tackles the challenges of dismissal of actions due to a lack of jurisdiction and the timing requirement of prescription.

This case arose out of a car accident in 2010 in Tangipahoa Parish. Plaintiffs initially filed in federal district court to recover damages for personal injuries, claiming the federal court had jurisdiction due to the diversity of citizenship between plaintiffs and defendants. Ms. Crowe, the defendant, had moved to dismiss due to her claim that she was a Louisiana resident at the time and, thus, diversity of citizenship did not exist. In 2011, the federal court denied Crowe’s motion.

However, in 2012 a different federal district court dismissed the plaintiff’s complaint due to lack of jurisdiction. In the current lawsuit, heard in state court, the defendant argued the case was prescribed on its face because it was filed over two years after the accident, and no defendant was served with process within the applicable period. Eventually, this issue was decided in a pre-trial proceeding, and then evidence regarding prescription was excluded from the trial. The trial court found for the plaintiffs, and the defendants motioned for a new trial based on the claim the court erred in denying the exception of prescription.

Insurance Dispute Lawyer Blog

Insurance Dispute Lawyer Blog

When injured on the job, your doctor knows best until you get a second opinion. While your primary care doctor may advise you to recover instead of resume working right away, if you get a second opinion that finds you capable of working, that second opinion can trump your primary care doctor’s opinion.

When injured on the job, your doctor knows best until you get a second opinion. While your primary care doctor may advise you to recover instead of resume working right away, if you get a second opinion that finds you capable of working, that second opinion can trump your primary care doctor’s opinion.  When you are injured on the job, it’s not always your employer’s or fellow employee’s fault. If you are injured while working by a third party, there are rules to follow when settling your claims. Following those guidelines is important because if you don’t, you may alter the workers’ compensation benefits owed to you.

When you are injured on the job, it’s not always your employer’s or fellow employee’s fault. If you are injured while working by a third party, there are rules to follow when settling your claims. Following those guidelines is important because if you don’t, you may alter the workers’ compensation benefits owed to you. Large waves and rough seas make boat travel a harrowing experience. But what happens if you are at work and fall out of bed during those stormy seas? Is the captain or company you work for liable under the Jones Act? The following case out of Louisiana helps answer the question; can I recover under the Jones Act if rough seas cause my back injury?

Large waves and rough seas make boat travel a harrowing experience. But what happens if you are at work and fall out of bed during those stormy seas? Is the captain or company you work for liable under the Jones Act? The following case out of Louisiana helps answer the question; can I recover under the Jones Act if rough seas cause my back injury?  People rely on public services daily, from fire departments to police officers. But what happens if a public entity is responsible for an injury? Can they be held liable for negligence? A recent case out of Grand Isle, Louisiana, shows how public entities can be shielded from liability for negligent conduct in some circumstances. It also helps answer the question; Can a state fire marshall be liable for inspector negligence in a wrongful death lawsuit in Louisiana?

People rely on public services daily, from fire departments to police officers. But what happens if a public entity is responsible for an injury? Can they be held liable for negligence? A recent case out of Grand Isle, Louisiana, shows how public entities can be shielded from liability for negligent conduct in some circumstances. It also helps answer the question; Can a state fire marshall be liable for inspector negligence in a wrongful death lawsuit in Louisiana? If you are walking down the aisle of a store and fall and injure yourself, you may think you have a winning lawsuit. However, that is not always the case. A recent lawsuit out of Gretna, Louisiana, establishes what a plaintiff needs to prove when filing a slip-and-fall lawsuit in Louisiana.

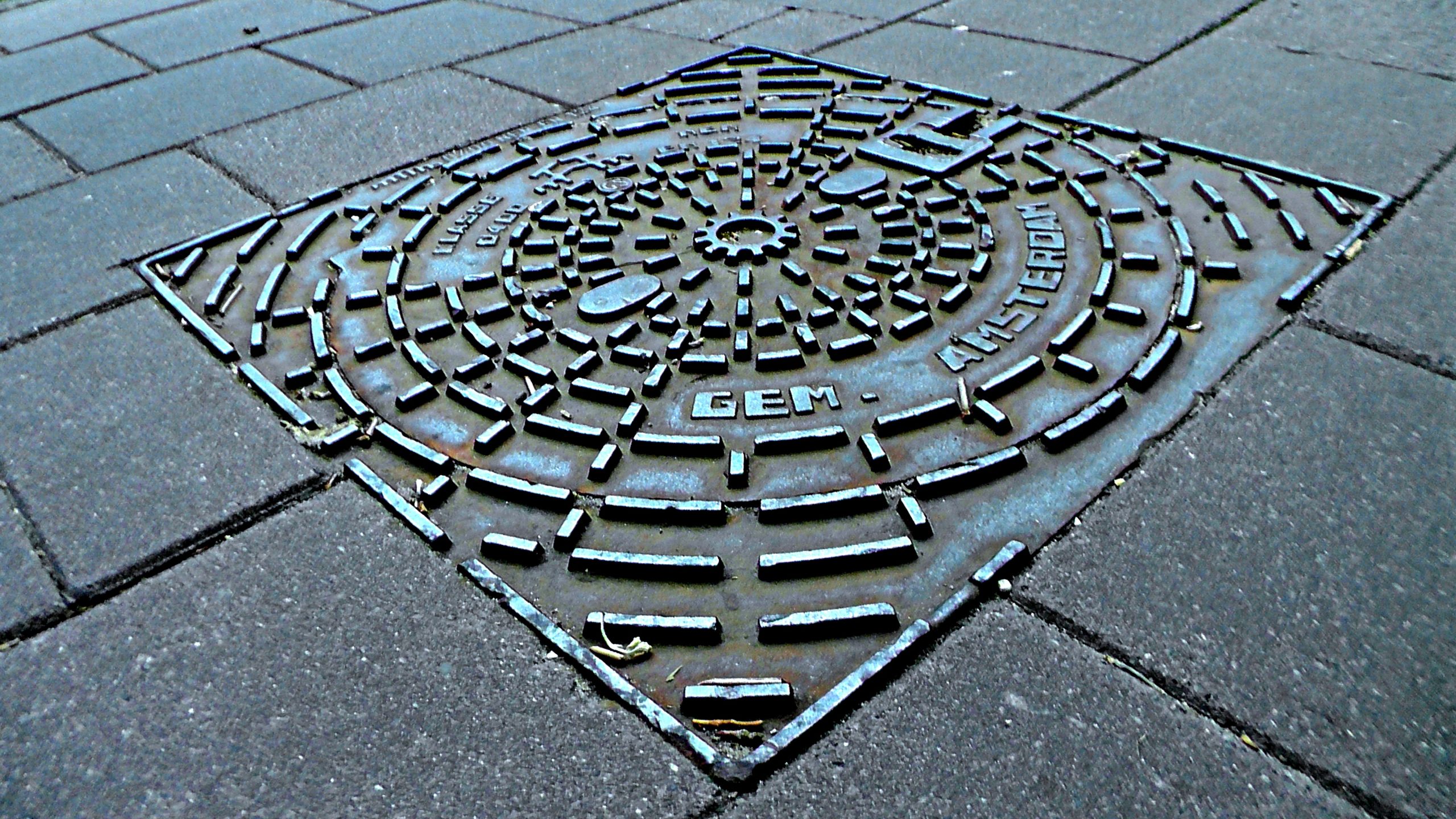

If you are walking down the aisle of a store and fall and injure yourself, you may think you have a winning lawsuit. However, that is not always the case. A recent lawsuit out of Gretna, Louisiana, establishes what a plaintiff needs to prove when filing a slip-and-fall lawsuit in Louisiana.  If you fall into a utility box with no cover, one would likely think they can recover for the damages they endured. However, in Louisiana, lawsuits aren’t as easy as you think. For example, is a company responsible for the utility box if it didn’t have “constructive notice” the ground hole cover was defective? The following lawsuit out of New Orleans shows the difficulties encountered when suing a utility company for a ground hole cover fall.

If you fall into a utility box with no cover, one would likely think they can recover for the damages they endured. However, in Louisiana, lawsuits aren’t as easy as you think. For example, is a company responsible for the utility box if it didn’t have “constructive notice” the ground hole cover was defective? The following lawsuit out of New Orleans shows the difficulties encountered when suing a utility company for a ground hole cover fall. We have all seen warning cones and signs in front of a wet floor at a business. But what happens when you fall in front of the warning cone? Can the company still be held accountable for your injuries? The subsequent lawsuit, Kenner, Louisiana, shows how courts review slip and fall lawsuits on wet floors with warning signs in plain sight.

We have all seen warning cones and signs in front of a wet floor at a business. But what happens when you fall in front of the warning cone? Can the company still be held accountable for your injuries? The subsequent lawsuit, Kenner, Louisiana, shows how courts review slip and fall lawsuits on wet floors with warning signs in plain sight. Schools are institutions for learning and public meeting spots for numerous events. People come and go daily and the safety of all visitors is paramount. But what happens when a visitor to a school is injured on the premise? Can a school be held liable for a visitor’s injuries on its campus? The following case out of Kentwood, Louisiana, shows the need for adequate proof when pursuing a trip and fall lawsuit against a school.

Schools are institutions for learning and public meeting spots for numerous events. People come and go daily and the safety of all visitors is paramount. But what happens when a visitor to a school is injured on the premise? Can a school be held liable for a visitor’s injuries on its campus? The following case out of Kentwood, Louisiana, shows the need for adequate proof when pursuing a trip and fall lawsuit against a school. When someone is injured in an accident, the question often arises, who is at fault? Certain factors must be met to find fault in an injury case. The following case outlines the elements which must be proven to file a personal injury lawsuit against a public park in East Baton Rouge.

When someone is injured in an accident, the question often arises, who is at fault? Certain factors must be met to find fault in an injury case. The following case outlines the elements which must be proven to file a personal injury lawsuit against a public park in East Baton Rouge.