Picture this: you’re enjoying your daily dose of local news when your name surfaces amidst a hailstorm of defamatory allegations. Your reputation takes a blow, and you decide to fight back by filing a lawsuit. This might sound like a gripping storyline from a TV courtroom drama, but for Mary R, this was a harsh reality. Today we’ll delve into her case, a fascinating battle highlighting the intriguing intersections between public figures, free speech, and defamation law.

Picture this: you’re enjoying your daily dose of local news when your name surfaces amidst a hailstorm of defamatory allegations. Your reputation takes a blow, and you decide to fight back by filing a lawsuit. This might sound like a gripping storyline from a TV courtroom drama, but for Mary R, this was a harsh reality. Today we’ll delve into her case, a fascinating battle highlighting the intriguing intersections between public figures, free speech, and defamation law.

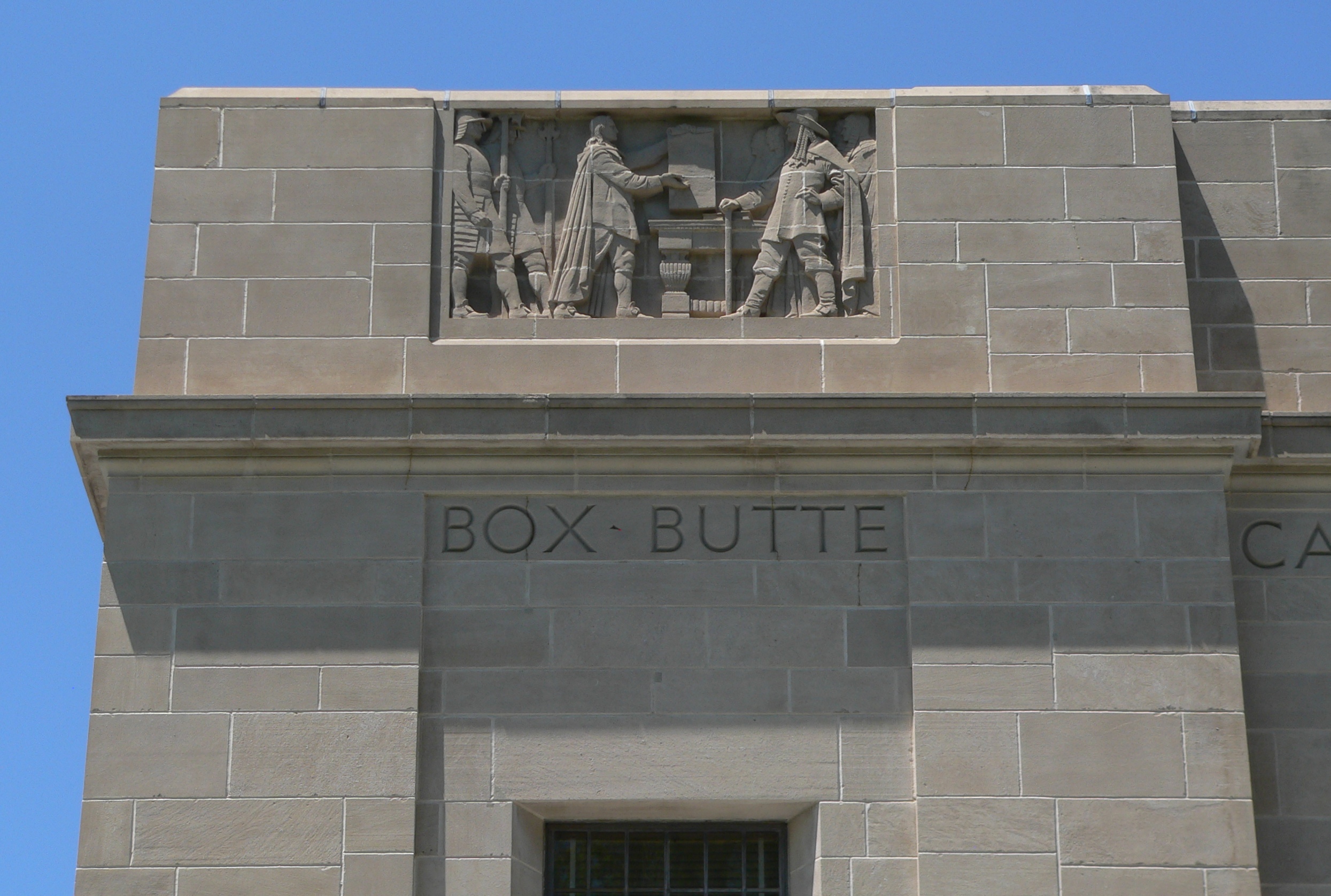

The otherwise bustling city of Baton Rouge, home to the Louisiana State University Tigers and famed for its vibrant Mardi Gras celebrations, became the backdrop of a less joyous event. It was here that Mary R found herself at the center of a legal maelstrom against John L and the consolidated governing body of the city itself. Mary R’s contention? She claimed that John L had cast aspersions on her, uttering false statements that tarnished her good name, while the city officials who could have reined in these allegations simply looked the other way. The case thus began, a small David standing against a massive municipal Goliath.”

Mrs. R had filed a lawsuit, claiming John L had made false and defamatory statements about her, while the members of the City Parish who could have prevented such defamation failed to do so. The defendants filed a special motion to strike, and the trial court dismissed Mary R’s claims with prejudice in July 2015.

Insurance Dispute Lawyer Blog

Insurance Dispute Lawyer Blog

Imagine, for a moment, living a life of normalcy, the humdrum of day-to-day routines, a steady job, a peaceful existence. Suddenly, an unexpected accident shakes your world, thrusting you into the tumultuous tides of legal proceedings. This is the daunting reality Patricia and Calvin Henderson found themselves in, initiating a monumental case against Amy Lashouto and her insurer, State Farm Mutual Automobile Insurance Company (State Farm).

Imagine, for a moment, living a life of normalcy, the humdrum of day-to-day routines, a steady job, a peaceful existence. Suddenly, an unexpected accident shakes your world, thrusting you into the tumultuous tides of legal proceedings. This is the daunting reality Patricia and Calvin Henderson found themselves in, initiating a monumental case against Amy Lashouto and her insurer, State Farm Mutual Automobile Insurance Company (State Farm). Louisiana’s Workers’ Compensation fund exists to pay employees injured at work. Payment can be used for medical care and lost wages. When parties sign a settlement agreement on payment terms, an employee may assume payment is imminent. In a recent case from Rapides Parish, an employee discovered some conditions in a settlement may delay payment.

Louisiana’s Workers’ Compensation fund exists to pay employees injured at work. Payment can be used for medical care and lost wages. When parties sign a settlement agreement on payment terms, an employee may assume payment is imminent. In a recent case from Rapides Parish, an employee discovered some conditions in a settlement may delay payment.  Injury in the workplace can usually be avoided with proper safety measures in place. Safety measures, however, become hard to enforce when minors and adults work in conjunction. This was the case for Austin Griggs, an illegally employed minor injured in a forklift accident while working.

Injury in the workplace can usually be avoided with proper safety measures in place. Safety measures, however, become hard to enforce when minors and adults work in conjunction. This was the case for Austin Griggs, an illegally employed minor injured in a forklift accident while working. A visit to the hospital is a stressful and anxious time for patients and family members. Most people, however, assume that their doctors are competent and will administer the proper standard of care. This was not the case for Richard Smallwood.

A visit to the hospital is a stressful and anxious time for patients and family members. Most people, however, assume that their doctors are competent and will administer the proper standard of care. This was not the case for Richard Smallwood.  The fundamental right to due process is a cornerstone of constitutional protection, ensuring that individuals are treated fairly within legal proceedings. Nevertheless, the delicate line between potential bias and genuine due process violations is not always easily discernible. A telling example can be found in a noteworthy case from East Baton Rouge, where the revocation of a psychologist’s license came under scrutiny for alleged due process infringements. This case probes the intricate considerations surrounding bias, procedure, and the boundary between legitimate legal actions and violations of constitutional rights.

The fundamental right to due process is a cornerstone of constitutional protection, ensuring that individuals are treated fairly within legal proceedings. Nevertheless, the delicate line between potential bias and genuine due process violations is not always easily discernible. A telling example can be found in a noteworthy case from East Baton Rouge, where the revocation of a psychologist’s license came under scrutiny for alleged due process infringements. This case probes the intricate considerations surrounding bias, procedure, and the boundary between legitimate legal actions and violations of constitutional rights. Unfortunately, accidents in the workplace are not uncommon. What happens, however, if you unknowingly signed an agreement making your employer immune from a liability claim? The following Lafourche Parish case outlines this predicament.

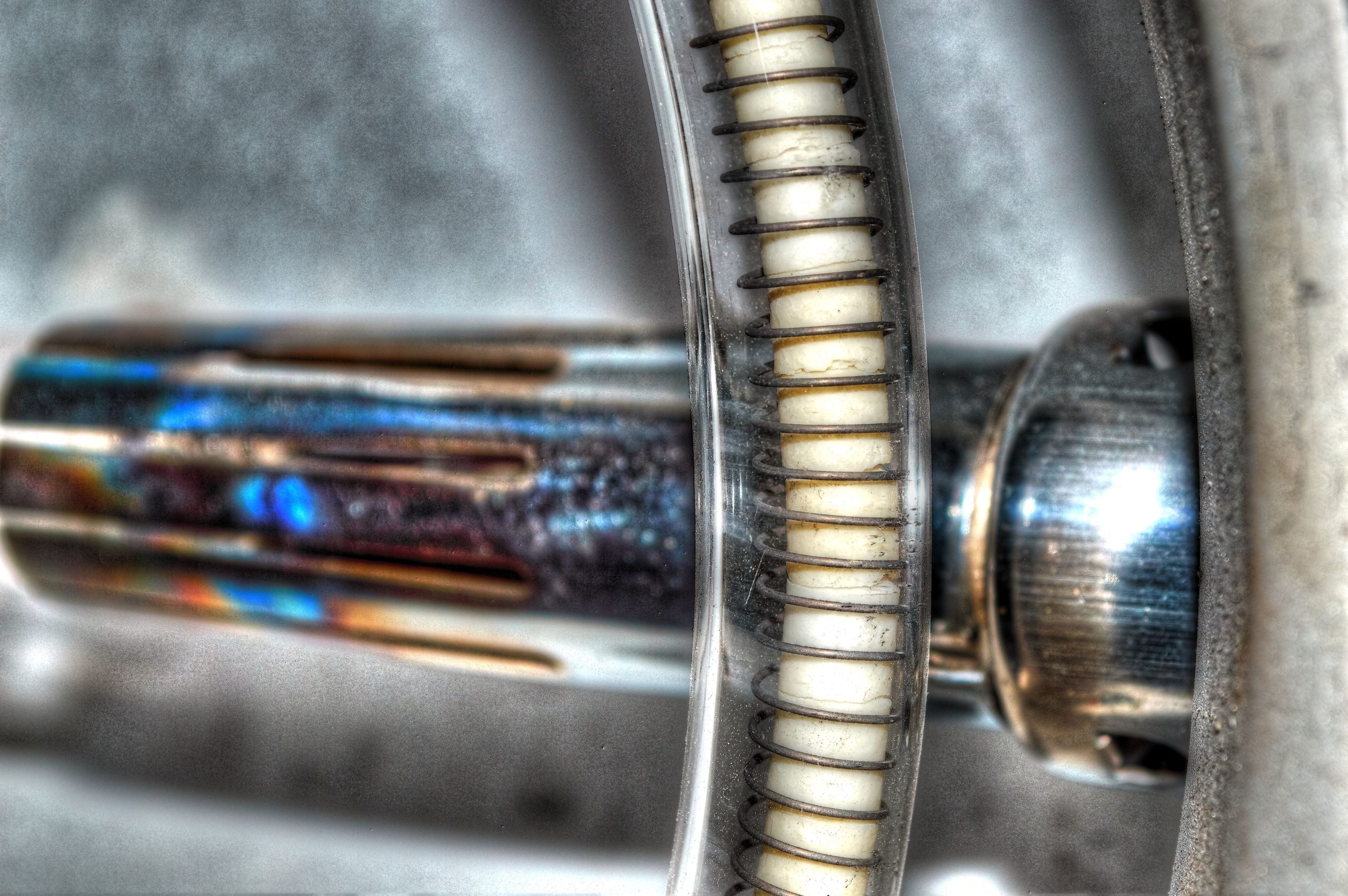

Unfortunately, accidents in the workplace are not uncommon. What happens, however, if you unknowingly signed an agreement making your employer immune from a liability claim? The following Lafourche Parish case outlines this predicament.  When an injury related to a product occurs, assigning fault can involve multiple parties. In personal injury litigation, crucial legal questions arise regarding whom the plaintiff can seek compensation from, if anyone, and the underlying theory of liability. The following case offers a valuable exploration of common liability theories often encountered in product-related injury cases.

When an injury related to a product occurs, assigning fault can involve multiple parties. In personal injury litigation, crucial legal questions arise regarding whom the plaintiff can seek compensation from, if anyone, and the underlying theory of liability. The following case offers a valuable exploration of common liability theories often encountered in product-related injury cases. Medical professionals are expected to uphold a standard of care in their practice. Unfortunately, life can present us with unfortunate circumstances where this standard is not met. When we experience injuries or worse due to the actions of those responsible for our treatment, healing, or diagnosis, medical malpractice claims can serve as a means to seek compensation and justice.

Medical professionals are expected to uphold a standard of care in their practice. Unfortunately, life can present us with unfortunate circumstances where this standard is not met. When we experience injuries or worse due to the actions of those responsible for our treatment, healing, or diagnosis, medical malpractice claims can serve as a means to seek compensation and justice. Some accidents are unpredictable, while others appear to be accidents waiting to happen. Having reliable witnesses, qualified experts, and an excellent attorney in either unpredictable or predictable cases could be the dividing line in determining your liability when an accident arises. For Larry Jeane, Sr. (“Mr. Jeane”), the deceased party in a two-car accident along Louisiana Highway 107, whose vehicle crossed the centerline and collided with another car carrying six adults and one minor, the courts were positioned to consider his liability after the accident.

Some accidents are unpredictable, while others appear to be accidents waiting to happen. Having reliable witnesses, qualified experts, and an excellent attorney in either unpredictable or predictable cases could be the dividing line in determining your liability when an accident arises. For Larry Jeane, Sr. (“Mr. Jeane”), the deceased party in a two-car accident along Louisiana Highway 107, whose vehicle crossed the centerline and collided with another car carrying six adults and one minor, the courts were positioned to consider his liability after the accident.