A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.

A settlement agreement can be an efficient way of resolving a claim and receiving compensation without a lengthy trial process. However, it is essential to understand what a settlement agreement does and does not cover to avoid surprises down the road if you later try to bring related lawsuits against other parties.

Kerry Maggio was injured in a car accident when he was hit by a vehicle driven by James Parker, who worked for Sandwich Kings. Brenda Parker owned the vehicle, which was insured by the Louisiana Farm Bureau. Maggio filed a lawsuit against James Parker, Sandwich Kings, and their insurers.

Maggio signed a settlement agreement and release of all claims with Brenda Parker and the Louisiana Farm Bureau. Neither James Parker nor Sandwich Kings was specifically mentioned in the release. Sandwich Kings and its insurer filed a summary judgment motion, arguing Maggio’s release applied to them because it released “all other persons” who were or might be liable for his injuries from the accident.

Insurance Dispute Lawyer Blog

Insurance Dispute Lawyer Blog

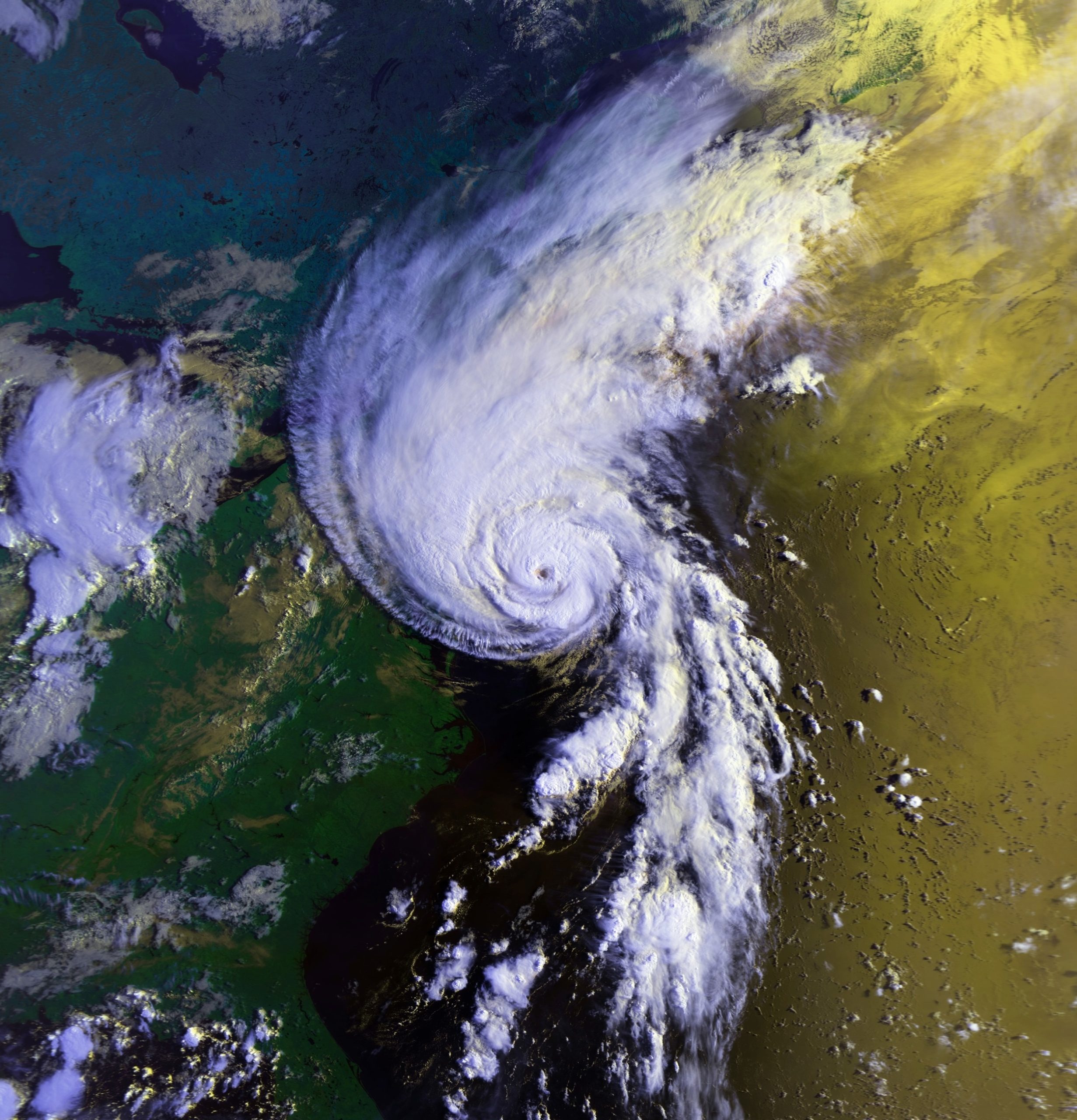

Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.

Over a decade after Hurricane Katrina, we have almost all heard of the difficult choices hospitals faced while trying to care for patients. This case involves a patient who was allegedly injured while being evacuated from a New Orleans hospital during Hurricane Katrina.  Under Louisiana law, there is a presumption the driver of a car that rear-ends another car acted negligently. However, this presumption of negligence can be overcome in certain situations, such as if the driver of the vehicle that was rear-end shifted lanes soon before the accident.

Under Louisiana law, there is a presumption the driver of a car that rear-ends another car acted negligently. However, this presumption of negligence can be overcome in certain situations, such as if the driver of the vehicle that was rear-end shifted lanes soon before the accident. The distinction between independent contractors and employees has always been something of a balancing test. This distinction becomes vital in workers’ compensation issues, where employees generally enjoy peace of mind with workers’ compensation in the event of an injury, whereas independent contractors usually do not. But are there some cases where an independent contractor can collect workers’ compensation benefits? The answer to this question is illustrated in the following appeal from the New Orleans Office of Workers’ Compensation.

The distinction between independent contractors and employees has always been something of a balancing test. This distinction becomes vital in workers’ compensation issues, where employees generally enjoy peace of mind with workers’ compensation in the event of an injury, whereas independent contractors usually do not. But are there some cases where an independent contractor can collect workers’ compensation benefits? The answer to this question is illustrated in the following appeal from the New Orleans Office of Workers’ Compensation. In order to recover under a homeowner’s policy, there are many requirements with which you must comply. One common requirement is providing the insurer with requested documentation and undergoing an examination under oath where the insurer can ask questions and gather information relevant to the claim. What happens if a homeowner delays undergoing an examination under oath?

In order to recover under a homeowner’s policy, there are many requirements with which you must comply. One common requirement is providing the insurer with requested documentation and undergoing an examination under oath where the insurer can ask questions and gather information relevant to the claim. What happens if a homeowner delays undergoing an examination under oath? No one should have to deal with sexual harassment in the workplace. If you are dealing with sexual harassment at work and you report it to your employer, you hope they will act on your report. How do actions taken by your employer affect your ability to recover for sexual harassment in court?

No one should have to deal with sexual harassment in the workplace. If you are dealing with sexual harassment at work and you report it to your employer, you hope they will act on your report. How do actions taken by your employer affect your ability to recover for sexual harassment in court? In the heart of Lafayette Parish, Louisiana, tragedy struck on Interstate 10 as a routine drive turned fatal. Arthur Huguley, behind the wheel of a tractor-trailer for AAA Cooper Transportation, found himself in a situation that would forever alter the lives of those involved. A blown-out tire, a series of events, and a wrongful death lawsuit brought forth by Curley Mouton’s surviving family members set the stage for a courtroom drama that unfolded with unexpected twists. In the end, a jury assigned fault, but the defendants, Huguley, AAA Cooper, and their insurer, were not ready to accept the verdict without a fight. This article explores the intricacies of their appeal, shedding light on the compelling arguments presented and the complexities of apportioning fault in a tragic accident.

In the heart of Lafayette Parish, Louisiana, tragedy struck on Interstate 10 as a routine drive turned fatal. Arthur Huguley, behind the wheel of a tractor-trailer for AAA Cooper Transportation, found himself in a situation that would forever alter the lives of those involved. A blown-out tire, a series of events, and a wrongful death lawsuit brought forth by Curley Mouton’s surviving family members set the stage for a courtroom drama that unfolded with unexpected twists. In the end, a jury assigned fault, but the defendants, Huguley, AAA Cooper, and their insurer, were not ready to accept the verdict without a fight. This article explores the intricacies of their appeal, shedding light on the compelling arguments presented and the complexities of apportioning fault in a tragic accident. Dealing with the aftermath of a flood is never fun. This is especially true when the flood damages one of your vehicles. This is the situation Michael Jacobs found himself in after one of his cars was damaged in a flood. After a long fight with his insurance company, he eventually prevailed and was awarded damages.

Dealing with the aftermath of a flood is never fun. This is especially true when the flood damages one of your vehicles. This is the situation Michael Jacobs found himself in after one of his cars was damaged in a flood. After a long fight with his insurance company, he eventually prevailed and was awarded damages.  When you think about medical malpractice lawsuits, a botched surgery or missed diagnosis are likely the first things that come to mind. The following case involves a less common situation involving purported medical malpractice involving physical therapy post-surgery. It analyzes the relationship between a doctor and a physical therapist and whether a doctor can be vicariously liable for the actions of a physical therapist.

When you think about medical malpractice lawsuits, a botched surgery or missed diagnosis are likely the first things that come to mind. The following case involves a less common situation involving purported medical malpractice involving physical therapy post-surgery. It analyzes the relationship between a doctor and a physical therapist and whether a doctor can be vicariously liable for the actions of a physical therapist. It can be challenging to interpret insurance policies, especially when they involve complex provisions such as coverage for an additional insured. Before signing an insurance policy, it is imperative to understand its language and what it does and does not cover. Here, the plain language of the insurance policy proved instrumental in the appellate court’s ruling.

It can be challenging to interpret insurance policies, especially when they involve complex provisions such as coverage for an additional insured. Before signing an insurance policy, it is imperative to understand its language and what it does and does not cover. Here, the plain language of the insurance policy proved instrumental in the appellate court’s ruling.